Government

Local government: Town Board, Planning Board and Zoning Board of Appeals

Welcome to the Town of Greenfield

Rural beauty and classic small-town charm, just minutes north of Saratoga Springs

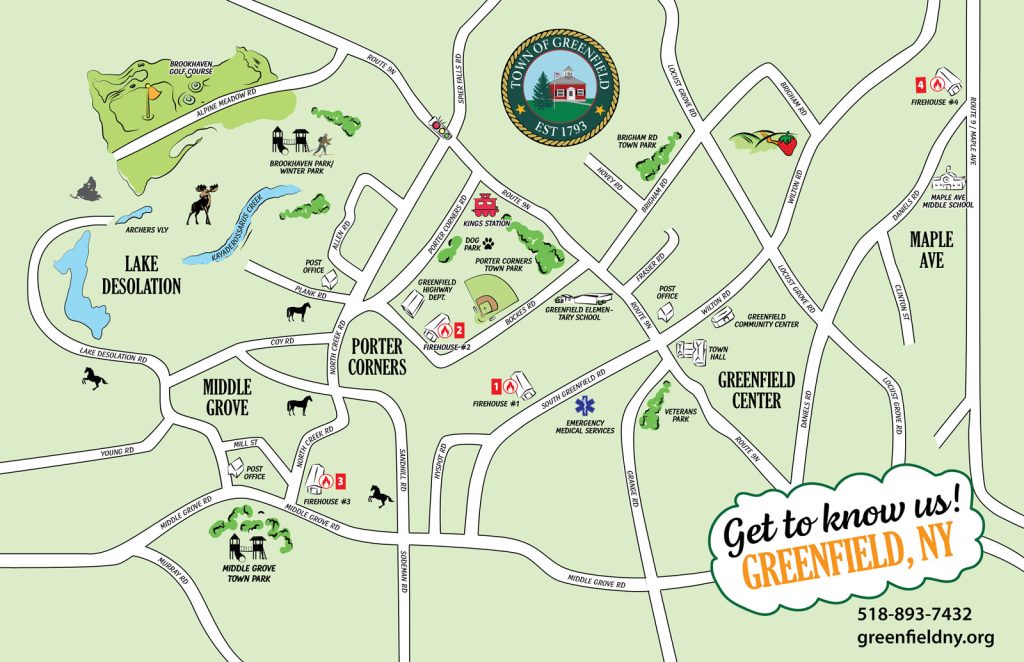

Located just five miles north of Saratoga Springs, the Town of Greenfield, N.Y., is home to 8,200 residents in the five hamlets of Greenfield, Porter Corners, Middle Grove, Lake Desolation and Maple Ave. It spans more than 41,000 acres of land bordering the Adirondacks and is the largest town, by square mile area, in Saratoga County.

Sign up for our latest recreation programs

Don’t miss our year-round events and sports programs

Upcoming Events & Meetings

Patriot Burial Markers Ceremony Day at the Ormsbee Cemetery in Greenfield

Community Event Submission Form

Thank you for visiting the Town of Greenfield’s website

We think that Greenfield is one of the most beautiful and peaceful places to live, with our vast open spaces and Adirondack landscapes. Our quiet country community is perfectly nestled just minutes from Saratoga Springs and is a reasonable drive to the 46 high peaks of the Adirondacks, and to cities like Albany, New York and Montreal.

Please don’t hesitate visit or contact any of us at Town Hall. We welcome your feedback and questions any time.

Newsletter Sign Up

7 Wilton Road

Greenfield Center, NY 12833

Monday – Thursday: 8:30 AM – 3:00 PM

Friday: 8:00 AM – 3:00 PM

Please check department pages for hours by department.

Contact Info

PO Box 10

Greenfield Center, NY 12833